AI in Auditing

The future of auditing lies in the synergistic collaboration between powerful AI and auditors.

AI systems are increasingly taking over repetitive and standardized tasks. For example, they can check all of a client’s documents in a fraction of a second, detect misstatements in the annual financial statements and identify inconsistencies between the balance sheet and the notes. This allows auditors to focus on complex assessments and decision-making.

The IQAudit© AI suite offers a wide range of use cases on demand. The idea is that AI can be used without technical expertise. Auditing firms can start using AI immediately, while the solution can also be expanded and customized to meet complex and differentiated client needs. The result is your company’s own highly specialized AI suite.

Typical use cases are:

AI in Auditing – Risk Analysis

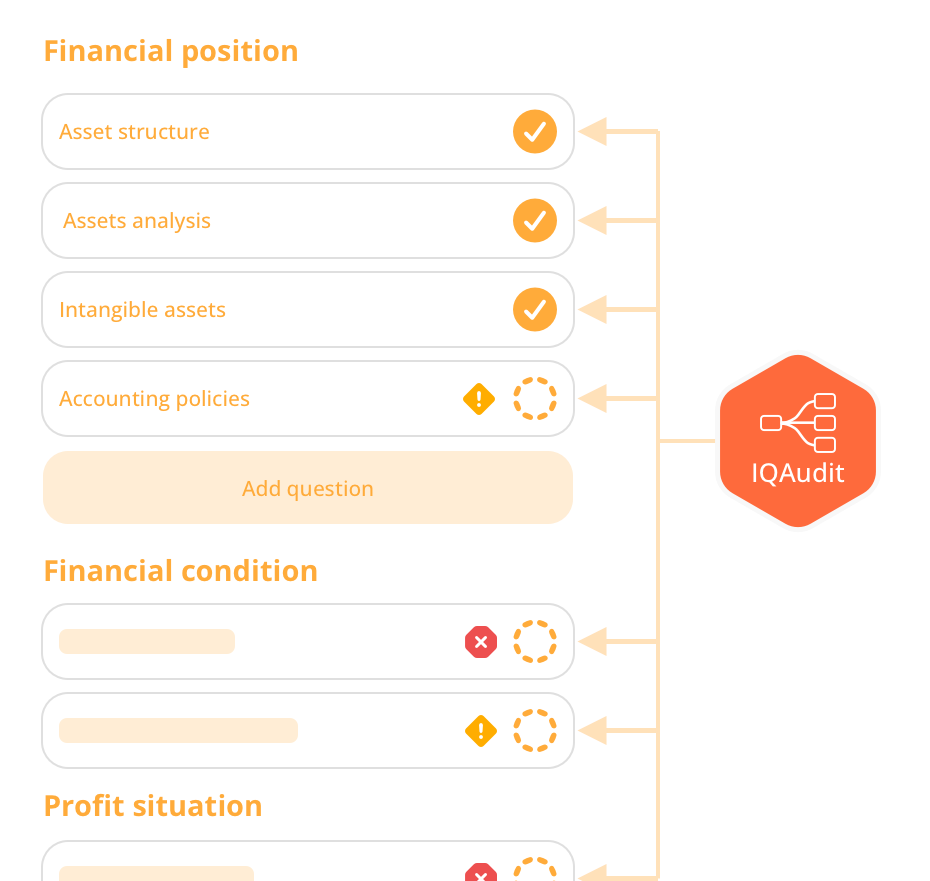

The AI proactively and comprehensively checks the client for fundamental risks. Key areas of review are based on the client’s assets, finances, earnings and liquidity.

Examples of identified risks include insufficient investment activity relative to the core business, misvaluation of key balance sheet items, implausible outliers in time series, or profitability trends that are unusual for the industry.

The AI analyses are automatically integrated into the audit evidence to be prepared. Upon request, specified balance sheet and income statement items can also be transferred automatically.

The materiality of changes in value compared to the previous year is assessed on a client-specific basis.

All stored analyses can be adapted by the auditor without any technical expertise. It is also possible to add custom analyses as needed. As a result, the auditing firm has a powerful risk analysis library at its disposal, which every auditor is expected to use. More information.

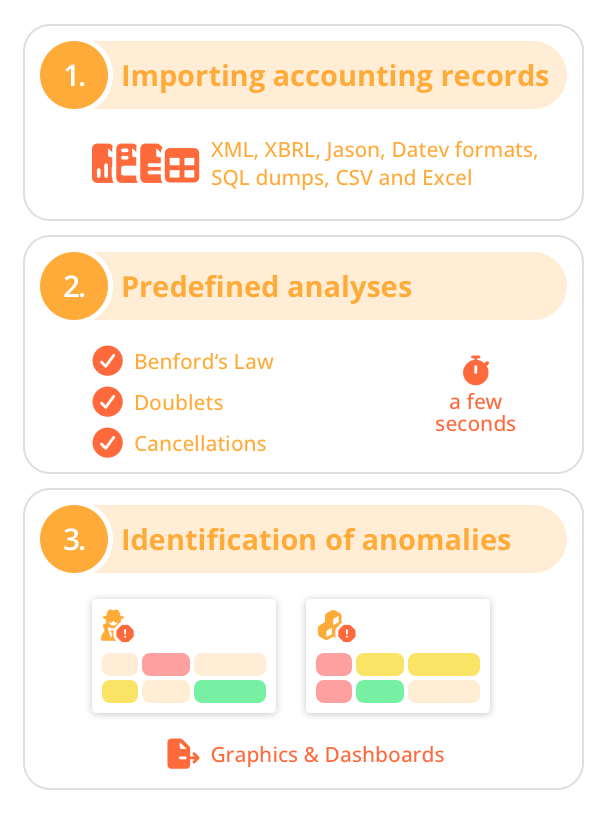

AI in Auditing – GOBD Data

All accounting entries for the audited client are imported on demand. IQAudit© supports all common import formats, including XML, XBRL, JSON, DATEV formats, SQL dumps, CSV, and Excel.

Within minutes, the AI examines all typical error cases, implausibilities, and potential irregularities. Common examples include unusual account combinations, entries made by technical users, a conspicuously high number of reversals, or unusually high and rounded amounts.

Additionally, an optimized analysis based on Benford’s Law is performed. More information.

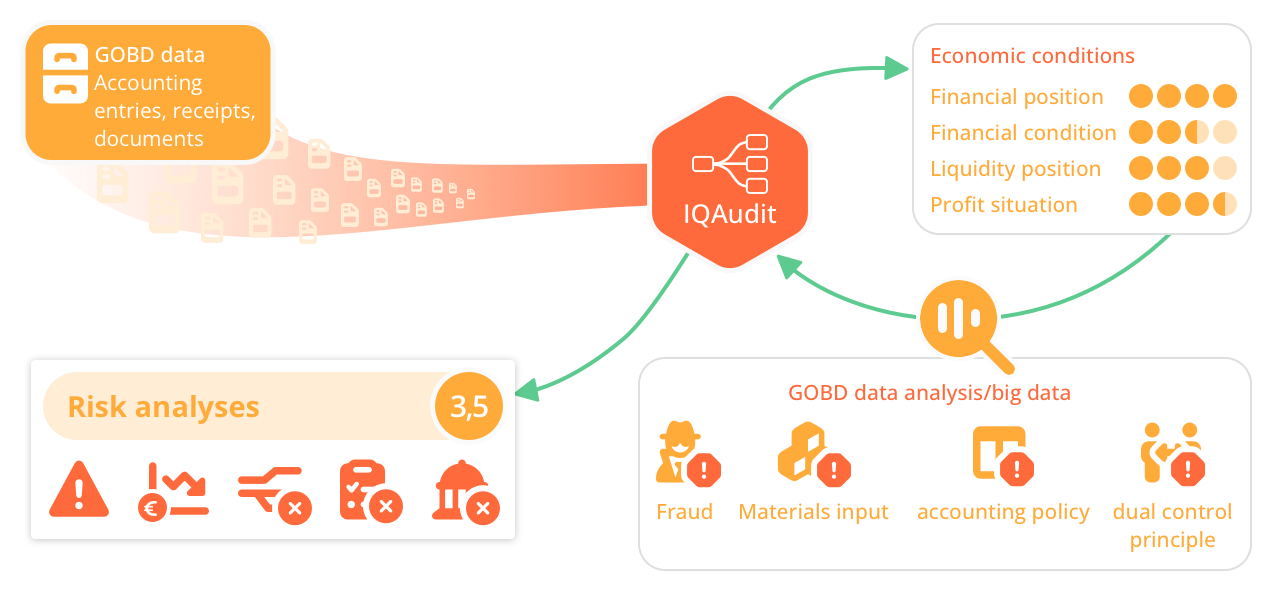

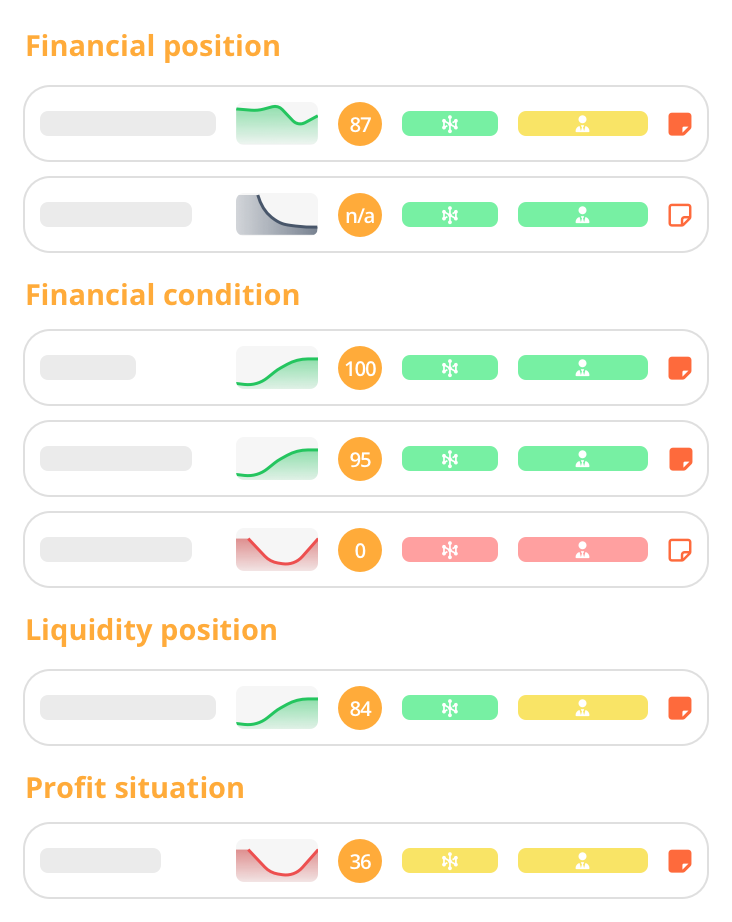

Assessment of Economic Circumstances

The AI automatically provides an analysis of the client’s economic circumstances.

This analysis is based on an assessment of the client’s assets, finances, earnings and liquidity.

Specifically, the assessment relies on 20 predefined key figures. Examples include the turnover rate of receivables, EBITDA margin, second-degree liquidity, and dynamic debt repayment capacity.

The auditing firm receives an evaluation of all key figures, each dimension (e.g., earnings situation), and the overall picture. Upon request, a client-specific AI model can be created, perfectly trained for the client’s situation using millions of data records.

All key figures can be customized and expanded as needed. As a result, the auditing firm has a powerful methodology at its disposal that serves as a binding starting point for every auditor’s assessment of the economic situation.

In addition to the use cases described above, IQAudit© supports a wide range of other applications.

For example, comparative and benchmarking data for any key figures can be provided digitally on demand. The respective peer groups and associated key figures can be dynamically adjusted without any technical expertise.

Another use case is the AI analysis of the notes and management report. In this case, inconsistencies between the annual financial statements and the values reported in the notes and management report are automatically detected. Expert consultation is recommended to tailor the solution to your specific needs.

Contact us now

Would you like to learn more about our SaaS solution IQThirdParty or schedule a demo appointment?

Thank you!

We have received your request and will get back to you shortly with all the information

Applications of AI in Auditing

The combination of human expertise and AI creates significant added value.

Decisions / Algorithms

Audit processes are increasingly supported by qualified AI recommendations. The AI identifies aspects that are not transparent to humans, for example when assessing the economic situation of the audited company. These modern approaches set new standards for efficiency and audit reliability. The combination of powerful algorithms and intelligent AI assessments provides auditors with an excellent foundation for their evaluations.

Generative AI / Production

Generative AI and agent-based AI are increasingly taking over the creation of mandatory documents at high quality. Typical use cases include the automated drafting of audit reports or financial statement presentations. AI assessments of complex issues are adjusted by the auditor and processed automatically. This results in intelligent end-to-end processes, from data collection to the final audit meeting.

Automation in auditing

AI-driven processes make it possible to automate manual and repetitive tasks and to use resources in a more value-adding way. Typical examples of automation in auditing include formal checks to ensure that client-submitted documents are complete, as well as the verification of totals and balances. This allows auditors to focus on more complex assessments and strategic risk analyses.

Intelligent data analysis / big data

AI-based data analysis makes it possible to analyse even highly complex data sets in their entirety and to identify patterns. Examples include automated document verification and the rapid identification of outliers in balance sheet and income statement items. Big data technologies enable 100% coverage instead of sampling. Technological progress is changing not only the efficiency of auditing, but also its quality and reliability.