AI-Based Risk Analysis

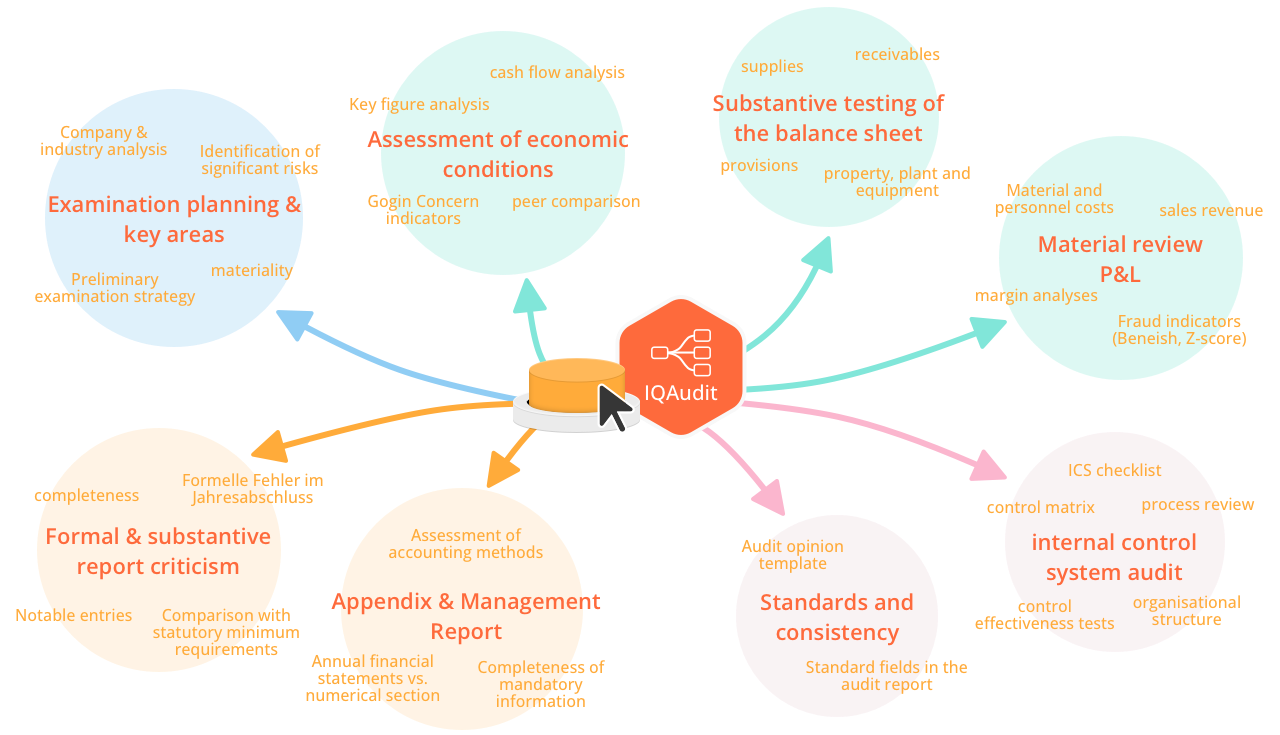

The IQAudit© Risk Analysis Library enables users to analyze the entire spectrum of accounting and auditing on demand. No prior knowledge of AI and no dedicated information technology infrastructure are required. The most important analyses are preconfigured in the form of the Top 25 AI queries.

Users can freely customize and extend these queries. The scope of input information is equally flexible: simple manual entries, the upload of any documents, and the import of complete accounting records are fully supported. The primary target users of the Risk Analysis Library are executives and experts in accounting, auditors, and internal auditors.

Thanks to the ability to customize evaluations without any programming knowledge, virtually any aspect can be added and analyzed. Examples include the policy-to-regulation comparison of internal guidelines against statutory requirements or the validation of extensive access rights logs.

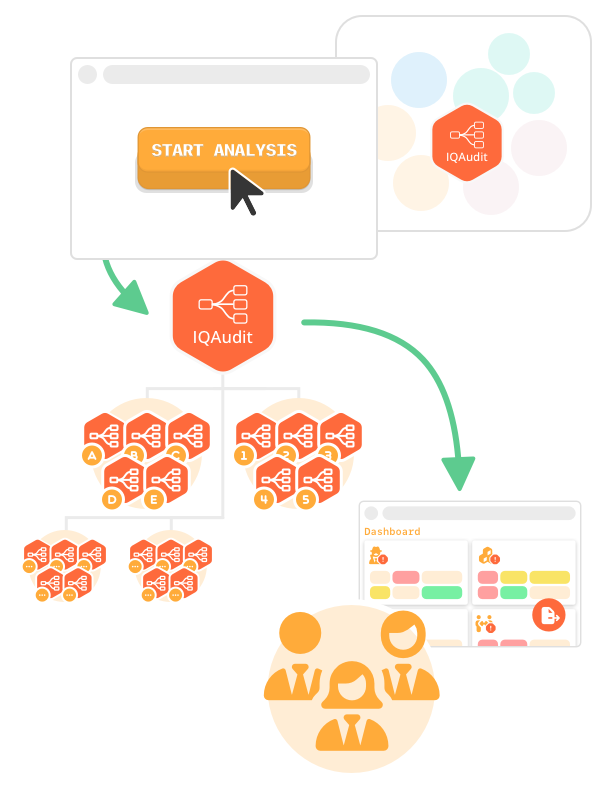

AI Risk Analysis at the Touch of a Button

The IQAudit© Risk Analysis Library enables users to analyze the entire spectrum of accounting and auditing on demand. No prior knowledge of AI and no dedicated information technology infrastructure are required. The most important analyses are preconfigured in the form of the Top 25 AI queries.

Users can freely customize and extend these queries. The scope of input information is equally flexible: simple manual entries, the upload of any documents, and the import of complete accounting records are fully supported. The primary target users of the Risk Analysis Library are executives and experts in accounting, auditors, and internal auditors.

Thanks to the ability to customize evaluations without any programming knowledge, virtually any aspect can be added and analyzed. Examples include the policy-to-regulation comparison of internal guidelines against statutory requirements or the validation of extensive access rights logs.

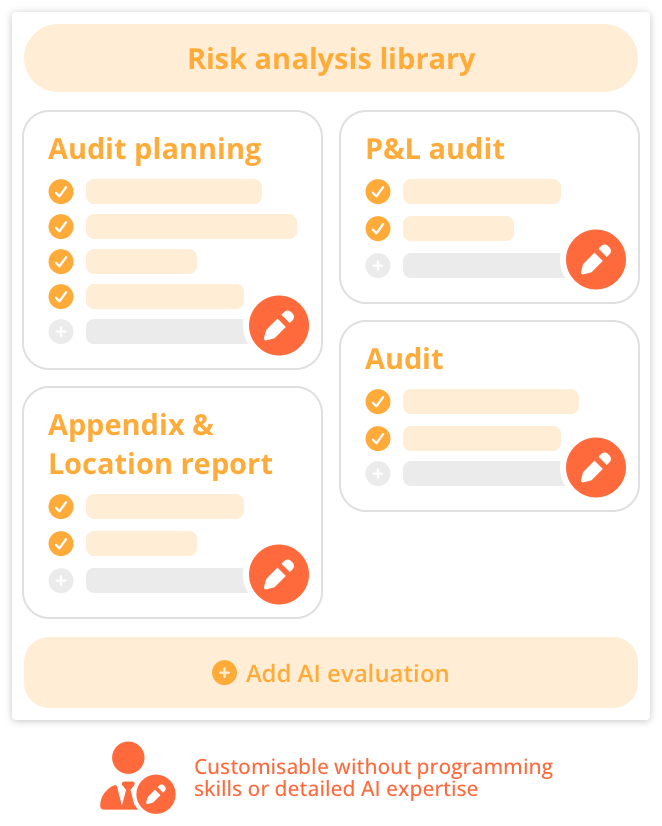

Customizing the AI Risk Analysis

For a quick start, the Top 25 AI analyses are preconfigured as best practices. Based on this foundation, users can develop their own risk analysis library without any programming skills or detailed AI knowledge. Existing AI analyses can be freely customized or deleted, and new analyses can be added just as flexibly. All users within a company using IQAudit© have real-time access to the updated risk analysis library after any changes.

A policy can mandate the use of the library for specific processes, leading to significant quality improvements and standardization of activities. A detailed permission management system ensures that changes can only be made by a small circle of experts. The results generated by the risk analysis library are made digitally available in a modern format, and flexible export options allow for further processing and documentation.

The scope of information fed into the AI is as flexible as the analyses themselves: simple manual entries, document uploads, and the import of all accounting entries are fully supported. The stored information is integrated into the AI analyses through dynamic references. For example, AI evaluations always refer to the specified balance sheet and income statement values for the audit year, the stored management report, or all accounting entries for the relevant financial year.

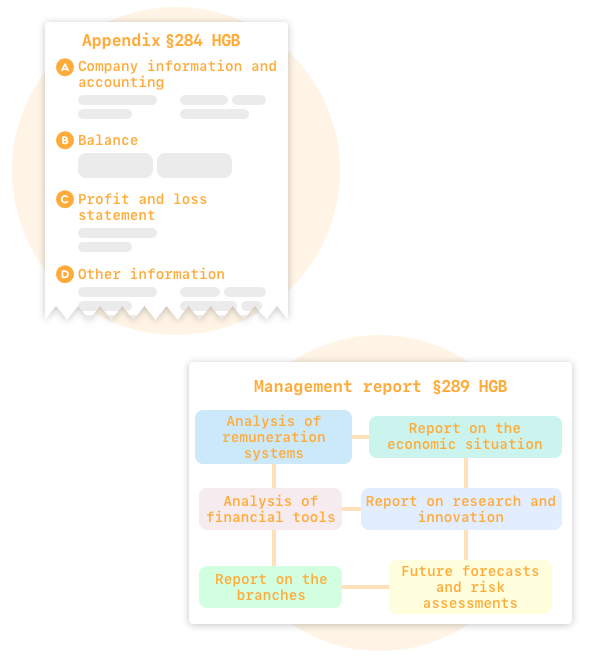

AI for Notes and Management Report

As a module of IQAuit©, the Risk Analysis Library already covers a wide range of topics.

The important aspect of auditing the notes and management report is addressed in depth.

The basis for auditing the notes and management report is whether the legally required components are included in the correct format. Within seconds, the notes are compared against the previous year’s figures and the current audit year. Inconsistencies are intuitively visible. The consistency check between the audit report and the numerical section of the notes saves time and significantly reduces the error rate.

All changes in a new version of the notes provided by the client become transparent on demand. Another example of notes evaluation is checking whether the disclosed information aligns with additional detailed documents, such as the fixed assets schedule or liabilities overview.

The management report must accurately reflect the company’s financial, asset, earnings, and liquidity position. Statements regarding future developments must be derived from the current situation and be consistent with industry trends. Any duplicates or contradictions are clearly identified.

Schedule a discussion with an expert

Would you like to learn more about our SaaS solution IQThirdParty or schedule a demo appointment?

Thank you!

We have received your request and will get back to you shortly with all the information