AI Accounting

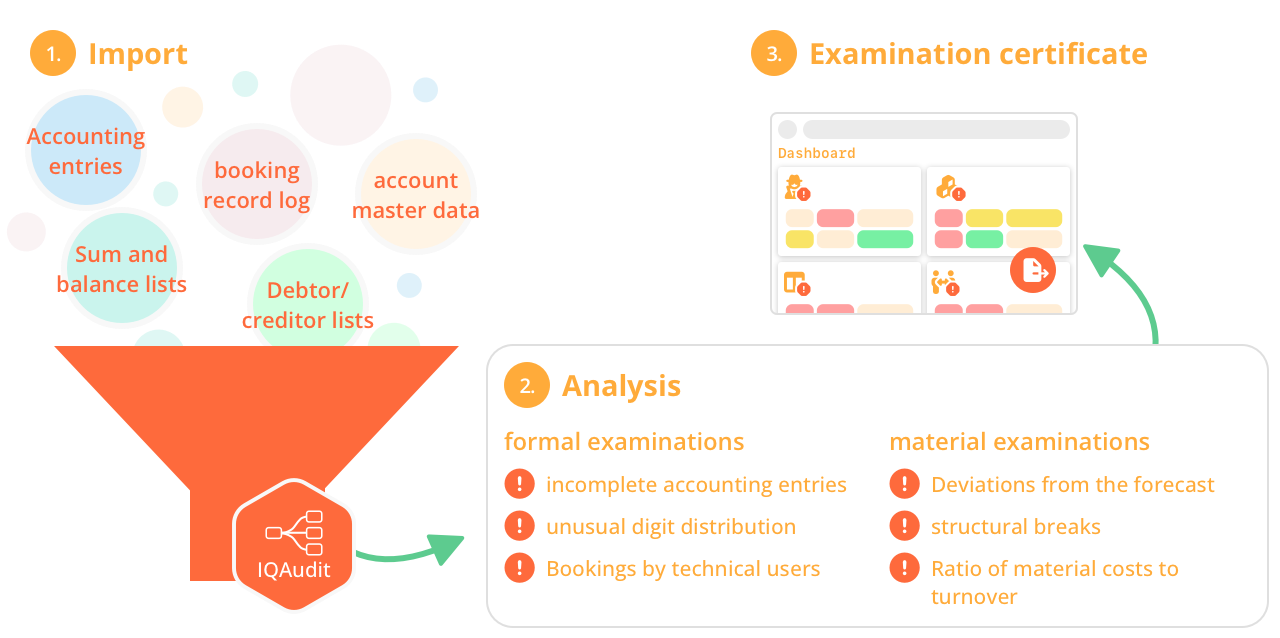

IQAudit©’s GOB data analysis examines the entire accounting system within minutes. It is intended for executives, accounting specialists, auditors, and examiners. The import of all accounting data is carried out efficiently with one single click.

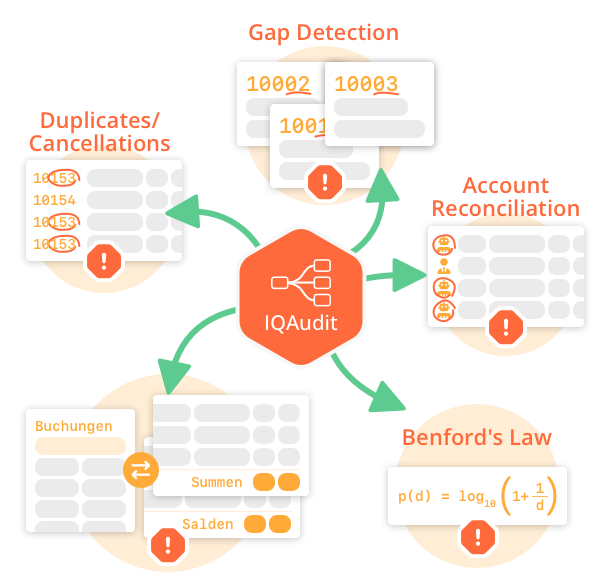

Subsequently, a wide range of formal and substantive checks is performed automatically. IQAudit© identifies, for example, all incomplete journal entries, unusual digit distributions in amounts (Benford’s law), postings by technical users, and excessively frequent duplicates or reversals. Examples of substantive checks include an inappropriate ratio of material costs to revenue, unexplained deviations from forecasts, and structural discrepancies compared to the previous year or industry benchmarks.

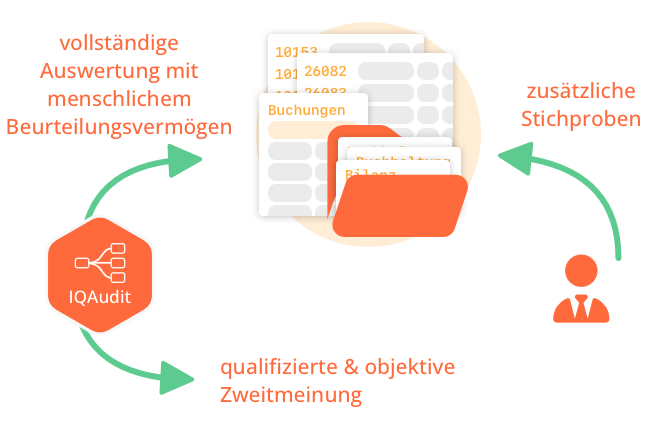

Clear-cut cases are determined precisely without the need for AI. Aspects that just a few years ago required human judgment are now assessed with the analytical precision of AI. AI in accounting enables consistently comprehensive evaluations, whereas a few years ago only sampling was possible. Examples of such aspects include postings between inappropriate accounts or unusual entries at the end of a quarter.

AI in Accounting and Big Data

IQAudit© offers GOB data analysis according to state-of-the-art standards. It is immediately evident whether all journal entries fully explain the trial balance and accordingly align with the balance sheet and income statement. Examples of further formal analyses include missing information in journal entries, postings by technical users and gaps in numbering sequences. An unusual digit distribution in amounts (Benford’s law) can be made transparent at the push of a button. As a result, the majority of errors in accounting are accurately detected.

Additionally, AI highlights anomalies that involve judgment or evaluation. Typical questions in this context include: “Are there indications of duplicate entries without exact matching of journal entries?”, “Are there postings between accounts that do not correspond?”, and “Are there signs of balance sheet manipulation through unusual year-end postings?”

AI in Accounting and Material Analysis

If the formal evaluations in the GOB data analysis result in significant added value through the precise use of AI, its role in substantive analyses is even more important. Analyses of millions of data sets that previously required human judgment are now carried out with high accuracy. For example, AI assesses whether there are implausibilities between revenue trends, personnel and material costs and incoming orders. This greatly increases the amount of information available for plausibility checks. Instead of sampling, full evaluations are conducted.

AI adds intelligent judgment to these comprehensive evaluations by highlighting unusual frequencies or content-related inconsistencies.

As a result, the auditor or accounting specialist receives a comprehensive and qualified second opinion for complex and detailed tasks.

Traceability and Effectiveness

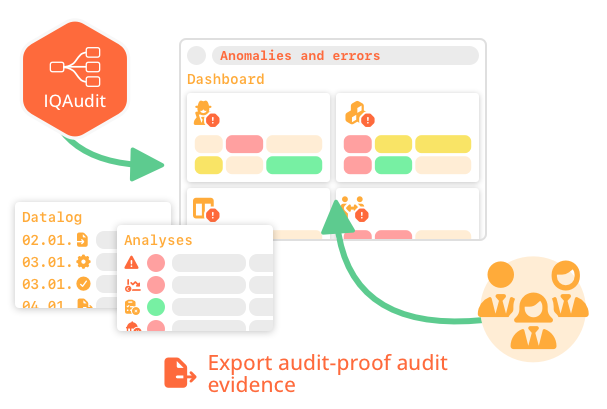

As a result, the accounting specialist, auditor, or examiner receives a qualified record of work covering extensive formal and substantive analyses. The record provides a structured overview of all analyses conducted. It shows which audit areas revealed no anomalies and which anomalies exist in which audit areas. These anomalies are specifically described and justified, with the justification always based on precise quantification.

Combined with the qualified input of the expert using IQAudit©, a high-quality work record is produced, which is stored in an audit-proof manner. Accurate export and flexible further processing are also supported. The entire GOB data analysis is embedded in a consistent workflow that guides the user from data import, through the multi-layered analyses, to the audit record.

Schedule a discussion with an expert

Would you like to learn more about our SaaS solution IQThirdParty or schedule a demo appointment?

Thank you!

We have received your request and will get back to you shortly with all the information